charitable gift annuity example

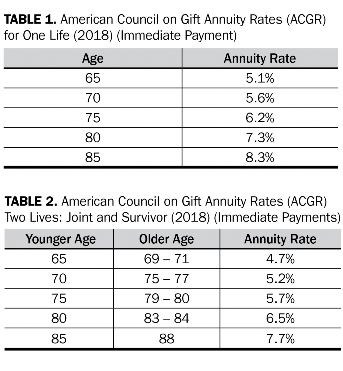

Based on their ages they will receive a payout rate of 59 percent 2950 each year for life and are also. A deferred charitable gift annuity could be right for you if.

Charitable Gift Annuities Kqed

A charitable gift annuity is a simple arrangement between you and St.

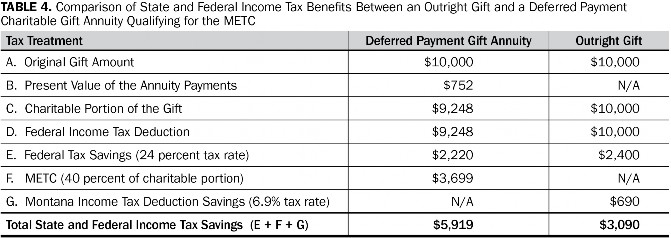

. Charitable Gift Annuities An Example. Dennis 75 and Mary 73 want to make a contribution to Whatcom Hospice but they also want to ensure that they have dependable income during their retirement. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation.

We understand that you may be interested in a. They donate 50000 in cash to Hadassah to establish a two-life charitable gift annuity. As with any other.

The following is a sample disclosure for a charity to consider using based upon advice and guidance from its own legal counsel. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation.

Also part of their 100000 is a charitable gift and therefore the Richards. A charitable gift annuity example. Charitable Gift Annuities An Example.

You have sufficient income now but want to supplement your cash flow later for example when you retire. Based on current calculations 380600 of the 5500 annual income will be free from income tax for 164 years. Charitable Gift Annuities An Example.

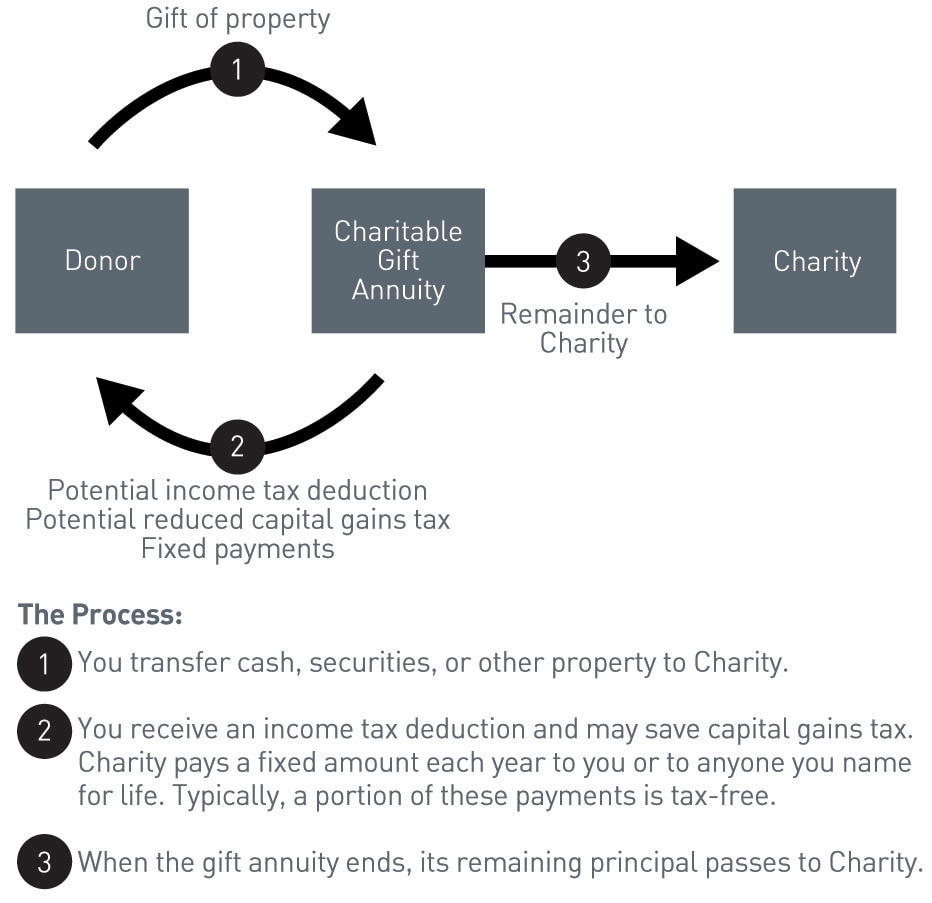

Christophers School that requires a one or two page agreement. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. In addition to these fixed annuity payments you receive a charitable tax-deduction in the year you make.

Charitable Gift Annuities An Example. An Example of How It Works. You will incur minimal or no costs to establish the.

A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Charitable Gift Annuities An Example. The minimum contribution to form a CGA is 25000 for individuals 60 years or older.

Charitable Gift Annuity. In exchange the charity assumes a legal obligation. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation.

Charitable Gift Annuities An Example. Charitable Gift Annuities An Example. If the sole annuitant will be nearest age 65 on the annuity starting date and the compound interest factor is 21082 the deferred gift annuity rate would be 21082 x 60.

After Anns death the balance of the invested funds will go to her favorite qualifying charities including a local animal shelter. Contact Tom Yates at 215 926-2545 or tyatestempleedu for additional information on charitable gift annuities or to chat more about the personal benefits of creating an annuity.

For Individual Members Gift Planning Options Annuities

Charitable Gift Annuities Cal Poly

Charitable Gift Annuities Maryknoll Fathers Brothers

Charitable Gift Annuity How It Benefits Others And You

Msu Extension Montana State University

Charitable Gift Annuity Shrink Wrapped Pamphlet Episcopal Church Foundation Forward Movement

Life Income Plans University Of Maine Foundation

Charitable Gift Annuity Wise Healthy Aging

Charitable Gift Annuity Deferred University Of Virginia School Of Law

Msu Extension Montana State University

City Of Hope Planned Giving Annuity

Charitable Gifts Archdiocese Of New York

Everything You Need To Know About A Charitable Gift Annuity Due

Charitable Gift Annuities Resource Center

Charitable Gift Annuities 1 Introduction Youtube

Charitable Gift Annuities Uchicago Alumni Friends

Key Differences Between Charitable Gift Annuities And Endowments Pnc Insights